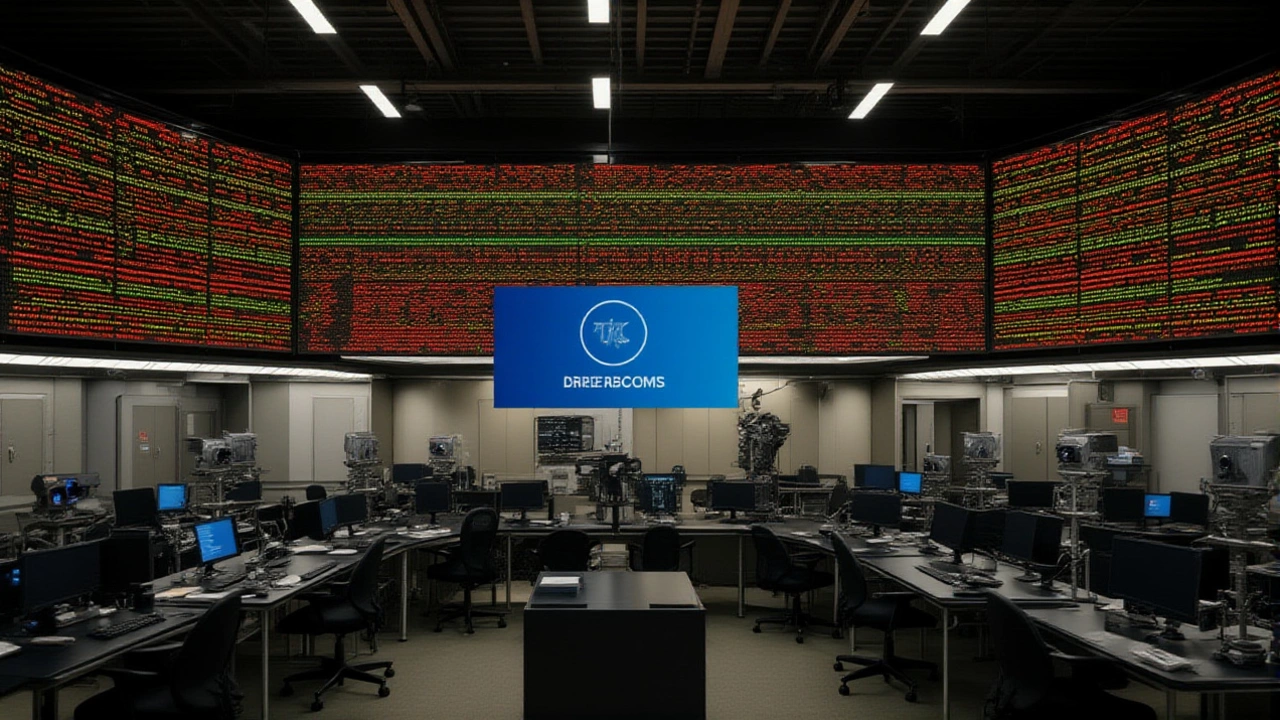

At 1:42 AM UTC on Friday, November 28, 2025, the world’s largest derivatives marketplace went dark—not from a cyberattack, not from a software crash, but because a cooling system failed. The CME Group, operator of the Chicago Mercantile Exchange, abruptly suspended all trading on its CME Globex platform after a temperature spike at a CyrusOne data center in Dallas disrupted critical infrastructure. For nearly four hours, traders couldn’t access contracts for oil, wheat, gold—or Bitcoin, Ethereum, and even the newly announced Solana futures. The twist? No hackers. No code bugs. Just a broken air conditioner.

How a Cooling Glitch Took Down a Financial Giant

It sounds almost absurd. In an era of quantum computing and AI-driven arbitrage, the global financial system stumbled because a chiller unit overheated. According to an emailed statement from a CME Group spokesperson in Singapore, the failure occurred at one of CyrusOne’s primary facilities supporting CME Globex. "The halt was caused by a cooling issue at CyrusOne data centers which disrupted operations across the exchange," the statement read. "Support teams were working diligently to resolve the problem and would update clients on pre-open details as soon as possible."

What made this worse was timing. The disruption hit during regular trading hours in Asia and Europe, just as U.S. markets were gearing up for the day. Traders watching live feeds saw the platform go silent—no price updates, no order fills, no liquidity. Cryptocurrency futures, which had become core to CME’s revenue growth, were hit hardest. Bitcoin and Ethereum contracts vanished from screens. Even Solana futures, scheduled to launch just two weeks later on December 15, 2025, were left in limbo.

"Something as seemingly mundane as temperature control brought one of the most critical financial platforms to a standstill," noted Echo Sphere’s YouTube analysis, which aired within hours of the outage. The video, viewed over 1.2 million times by Saturday morning, captured the unease across trading floors from Chicago to Singapore. "This isn’t a glitch. It’s a warning."

The Hidden Infrastructure Behind Your Trades

Most retail investors think of CME as a digital exchange. But behind every trade is a physical building—with servers, cooling pipes, backup generators, and electrical grids. CyrusOne, headquartered in Dallas, operates 40+ data centers worldwide and serves as the backbone for over 30 financial institutions, including the Chicago Board of Trade, NYMEX, and COMEX. Its failure doesn’t just affect CME—it ripples through every market that relies on its uptime.

For years, Wall Street assumed cloud infrastructure was bulletproof. But this incident exposed a blind spot: third-party physical dependencies. A single point of failure in a Texas data center could freeze trading on commodities that move global food prices, energy costs, and even crypto valuations. "We’ve spent billions on cybersecurity," said one anonymous CME risk officer, speaking off-record. "But we didn’t budget enough for the guy who checks the chiller filters."

Market Reactions and Regulatory Concerns

By 5:30 AM UTC, trading resumed—but not without scars. Futures prices jumped erratically in the first 15 minutes of reopening, as traders scrambled to reposition. The CME later confirmed no data was lost, and orders were preserved. Still, losses mounted. Market makers estimated $180 million in missed opportunities across energy and agricultural contracts alone. Crypto exchanges like Binance and Coinbase reported a 22% spike in withdrawal requests from U.S. clients, as fears grew about systemic fragility.

Regulators took notice. The Commodity Futures Trading Commission (CFTC) issued a rare public statement, urging all designated contract markets to submit detailed resilience plans for third-party infrastructure by January 15, 2026. "This isn’t about blaming CyrusOne," said CFTC Chair Rostin Behnam in a press briefing. "It’s about recognizing that financial stability now depends on the reliability of a cooling tower in Dallas."

What’s Next for CME and the Financial Infrastructure

CME’s planned 2026 upgrades—announced in its November 17, 2025 Globex notice—aim to phase out legacy copper handoffs in favor of fiber-optic redundancy. But those changes won’t fix physical vulnerabilities. In the wake of the outage, CME confirmed it’s accelerating a multi-year project to diversify its data center footprint. Sources say talks are underway with Equinix and Digital Realty to establish backup facilities in Chicago and London.

Meanwhile, CyrusOne has pledged to overhaul its cooling protocols, installing real-time thermal monitoring and redundant chillers at all financial-sector facilities. The company declined to say whether the failed unit was under warranty or if maintenance had been delayed due to budget cuts. "We take full responsibility," a CyrusOne spokesperson said. "We’re rebuilding trust one degree at a time."

The Solana futures launch, originally slated for December 15, 2025, was quietly postponed to January 12, 2026. CME didn’t issue a reason. But insiders say the delay is less about product development—and more about proving the system won’t melt down again.

Why This Matters to You

If you hold ETFs, pensions, or even crypto, this matters. Financial markets don’t just run on algorithms. They run on air conditioners. On power grids. On the people who check the temperature logs at 3 a.m. in a warehouse in Texas. When those systems fail, your investments freeze—not because the market crashed, but because the cooling system did.

It’s a sobering reminder: the most advanced financial systems are still built on the most basic human infrastructure. And sometimes, the weakest link isn’t a hacker. It’s a broken fan.

Frequently Asked Questions

How long was trading halted, and when did it resume?

Trading on the CME Globex platform was suspended for approximately four hours, from 1:42 AM UTC to around 5:30 AM UTC on November 28, 2025. Markets reopened with a staggered restart, beginning with equity index and interest rate contracts before gradually restoring commodities and crypto futures. No official statement confirmed the exact restart time, but market data feeds resumed fully by 5:45 AM UTC.

Were cryptocurrency futures affected, and which ones?

Yes, all crypto futures traded on CME Globex were suspended, including Bitcoin (BTC), Ethereum (ETH), and the newly announced Solana (SOL) futures. Solana contracts, scheduled to launch on December 15, 2025, were in their final testing phase and had already been listed on the exchange’s product roadmap. The outage delayed their official debut to January 12, 2026, as CME sought to verify system stability.

Was this a cyberattack or software error?

No. Both CME Group and CyrusOne confirmed the cause was purely physical: a cooling system malfunction at CyrusOne’s Dallas facility. No intrusion, no malware, no code failure was detected. The incident underscores a growing concern in finance: physical infrastructure failures—like power surges, HVAC breakdowns, or water leaks—pose greater systemic risk than most cyber threats.

How does this affect retail investors and pension funds?

Retail investors holding ETFs tied to commodities or crypto may have experienced price gaps or delayed settlements during the outage. Pension funds and institutional traders relying on CME for hedging lost critical windows to lock in prices, potentially impacting returns. While no direct losses were reported, the event exposed a hidden vulnerability: even "safe" assets like gold or soybean futures are only as reliable as the air conditioning in a Texas data center.

What’s being done to prevent this from happening again?

CME is accelerating its plan to diversify data center partners beyond CyrusOne, with talks underway with Equinix and Digital Realty for redundant infrastructure in Chicago and London. CyrusOne has committed to installing dual-redundant cooling systems and real-time thermal alerts at all financial-sector facilities. The CFTC is also requiring all major exchanges to submit physical resilience plans by January 15, 2026, marking the first regulatory push to treat data center infrastructure as critical national financial infrastructure.

Why is this incident considered a turning point for financial markets?

This was the first time a global financial exchange halted trading due to a non-digital failure. It shattered the illusion that modern markets are purely digital. The incident proved that the most advanced trading systems are still tethered to physical hardware—and that single points of failure in third-party infrastructure can trigger cascading market disruptions. Regulators, investors, and exchanges now acknowledge: if you can’t cool your servers, you can’t trade your futures.